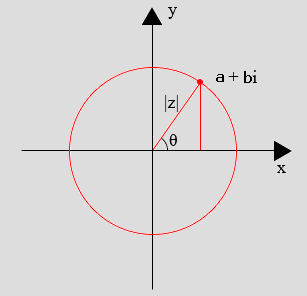

Imagem:Planoargandgauss.PNG

De WikiMat

Sem resolução maior disponível.

Planoargandgauss.PNG (307 × 296 pixels, tamanho: 6 KB, tipo MIME: image/png)

Note: As part of their calculations, Rate - Hub assumes monthly property taxes of $400 and monthly heating costs of $150. Top Canadian bankers back policies to cool down the the housing industry to bring of a soft landing, where prices stabilize gradually. An online ad for Kevin Bownick's services says that Kevin specializes to help to match clients needing private second mortgages with investors ready to fund them

(he) understands how difficult it can be sometimes for people to get bank financing. Dominion home loans are seeing a better rate of rejection and clients have to submit multiple applications to several institutions before finding a lender that work well, he added. For the first time ever, The Motley Fool will reveal the startling findings of their proprietary research into IPOs

the results ones could change just how you invest forever. It remains unclear if the modern rules will modify the sky high house prices in Vancouver.

One more step: Please confirm your subscription through the email sent to you. Because the market is unregulated, it falls outside the purview of public scrutiny. Here's a go through the company, its role inside Canadian mortgage broker vancouver landscape and the way the discovery of fraud among its brokers a couple of years ago continues to own ripple effects today. We expect the softness, any softness, in new prime insured activities is going to be offset with a growing amount of renewals, and the introduction individuals uninsured lending product, which could capture some with the previously insurable product. Since the proposed amendments to the regulations (Regulations) towards the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) were released in June 2018, regulated entities (REs) are already anxiously. In some loan-to-value categories, premiums raises by more than a whole percentage point in the value of the mortgage, effective March 17, 2017. To be clear, these changes don't mean that affected borrowers won't still have usage of mortgages, but they do mean the borrowers can have fewer options than before and really should expect to pay for rates which can be higher compared to the lowest available. 1, Elvira Kurmisheva the federal government's new borrower " stress test " will ensure it is far tougher to obtain a mortgage broker vancouver at a federally regulated lender, being a bank.

The term prime rate refers towards the interest rate that banks charge their preferred customers, or those with the highest fico scores. But the federal government-owned Canada Mortgage and Housing Corp, comes with an even greater influence over that country's market. She holds a patent and has co-authored a lot more than 15 scientific publications that are actually cited over 480 times. Toronto housing sector heats up in June: Sales jump 10%, listings fall. It tightened mortgage rules last fall, requiring a stress test to make certain borrowers are prepared for their mortgage in the Bank of Canada's posted mortgage rate. The amount of households who have a HELOC and home financing secured against their house has increased by nearly 40% since 2011. The required size of a new credit line may now be significantly reduced. The latest reminder of how fragile the specific situation is arises from Manulife Bank's Homeowner Debt Survey , which found that 72 per cent of mortgage holders wouldn't be able to manage a 10% surge in their monthly premiums. Roughly 90 per cent of those investments, the sources said, have ended in a very loss or are at likelihood of doing so, and Fortress projects make up greater than half from the investments.

Histórico do ficheiro

Clique em uma data/horário para ver o ficheiro tal como ele se encontrava em tal momento.

| Data/Horário | Usuário | Dimensões | Tamanho do ficheiro | Comentário | |

|---|---|---|---|---|---|

| (actual) | 09h57min de 16 de Abril de 2008 | Tomé (Discussão | contribs) | 307×296 | 6 KB |

- Editar este ficheiro utilizando uma aplicação externa

Consulte as instruções de instalação para mais informação.

Ligações

As seguintes páginas apontam para este ficheiro: